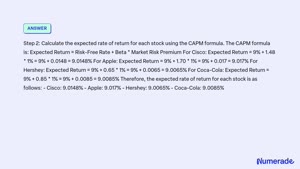

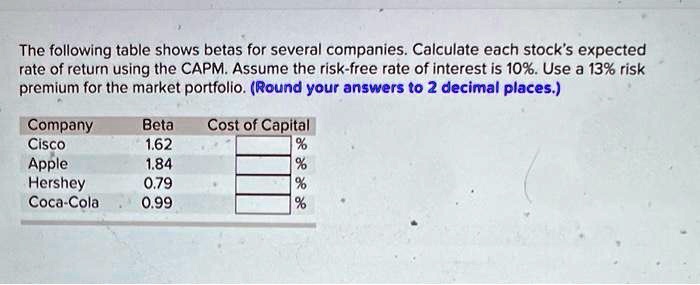

SOLVED: The following table shows betas for several companies: Calculate each stock's expected rate of return using the CAPM: Assume the risk-free rate of interest is 10%. Use a 13% risk premium

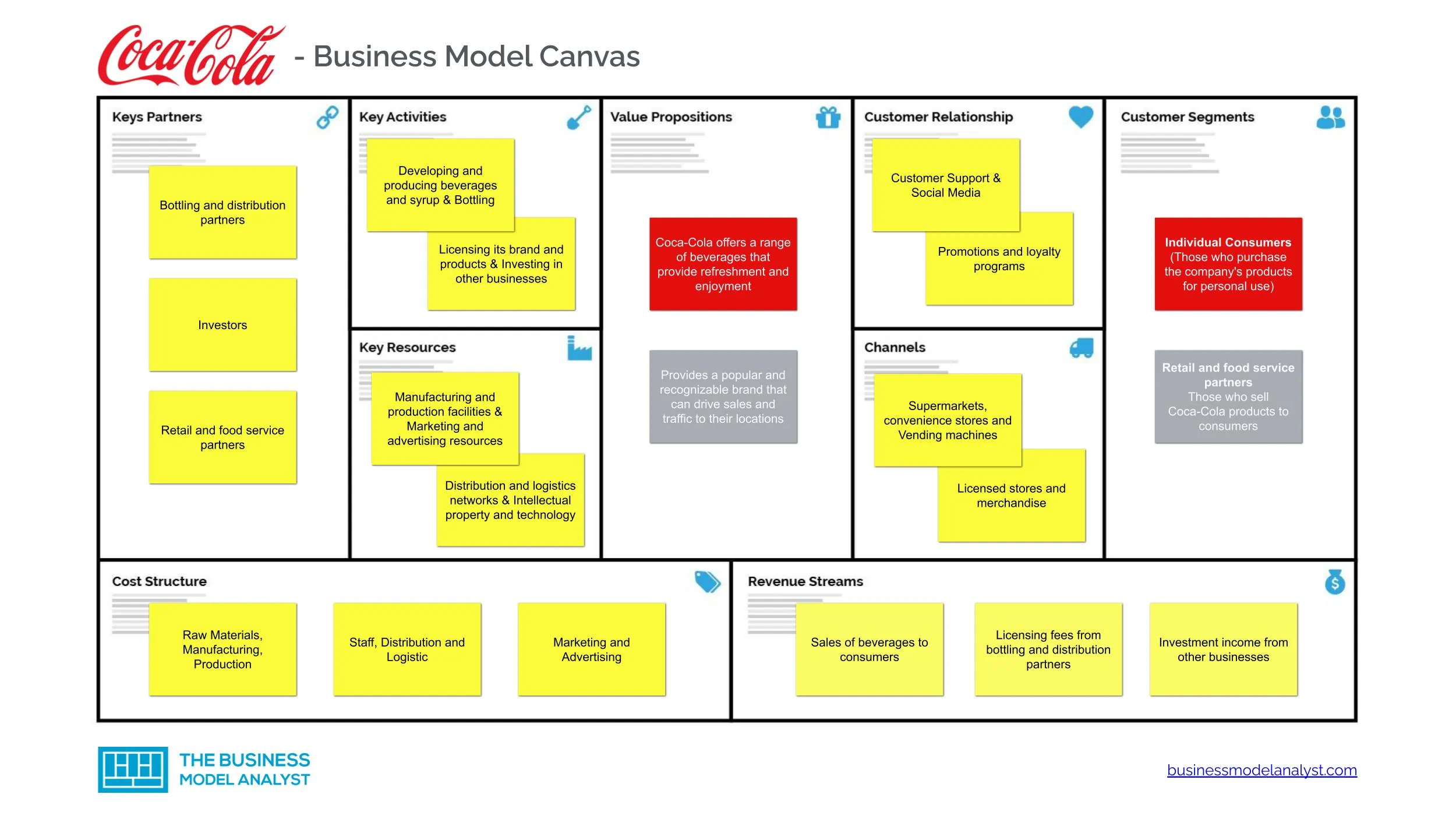

Chapter 13 Cost of Capital. Chapter Outline A First Look at the Weighted Average Cost of Capital 13.2 The Firm's Costs of Debt and Equity Capital. - ppt download

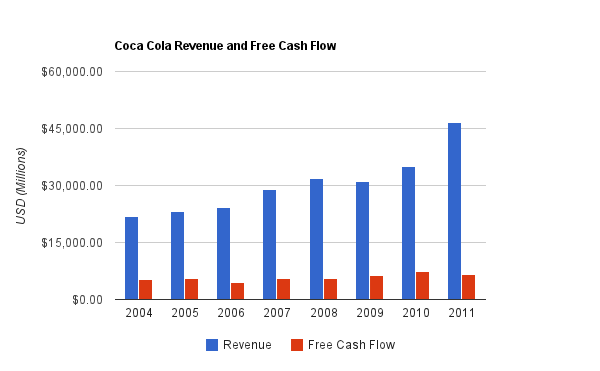

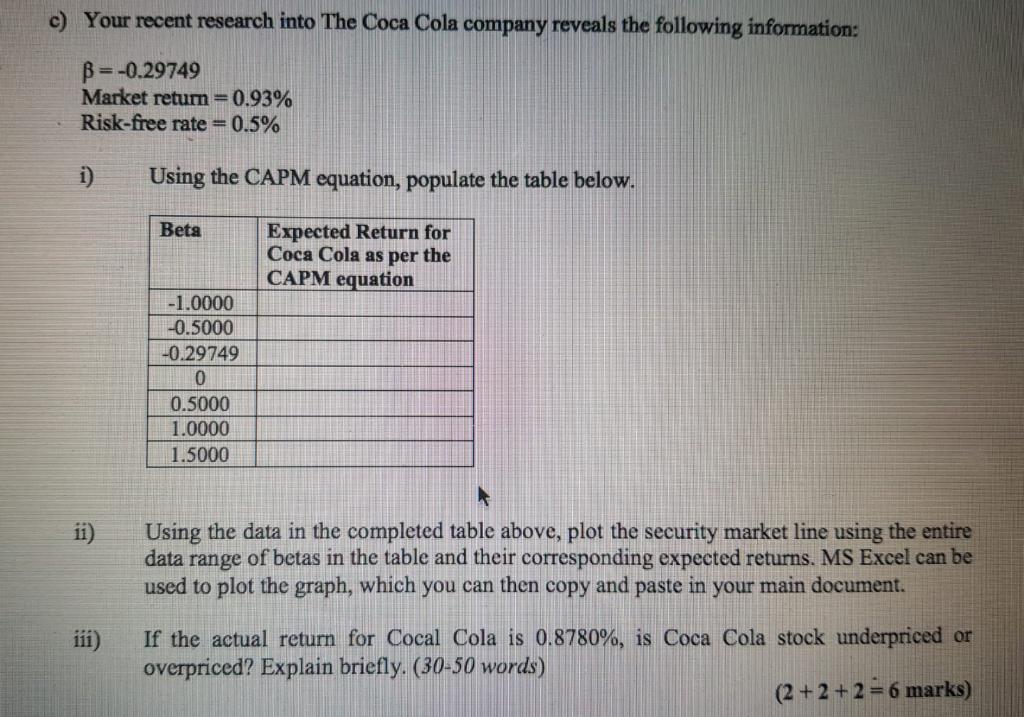

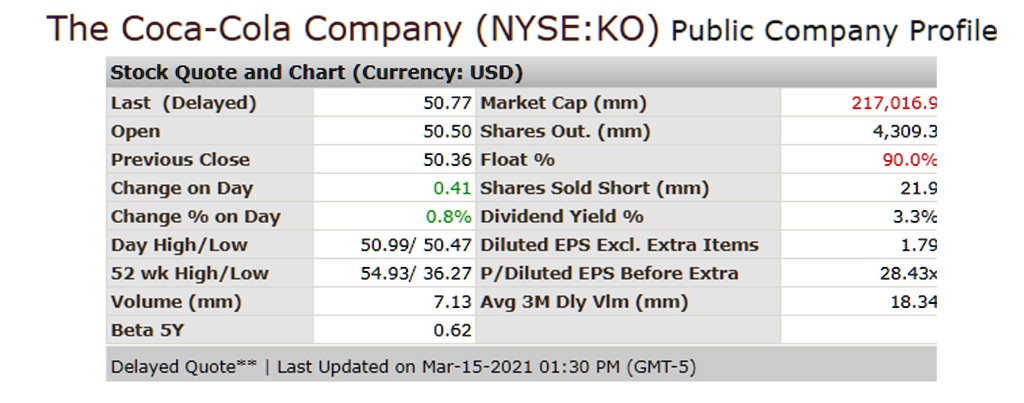

SOLVED: Consider information about Coca Cola Company (KO) stock on March 15, 2021: (a) Suppose the market risk premium is 6.71% and the risk-free interest rate is 1.64% (from Ibbotson/Datastream data using

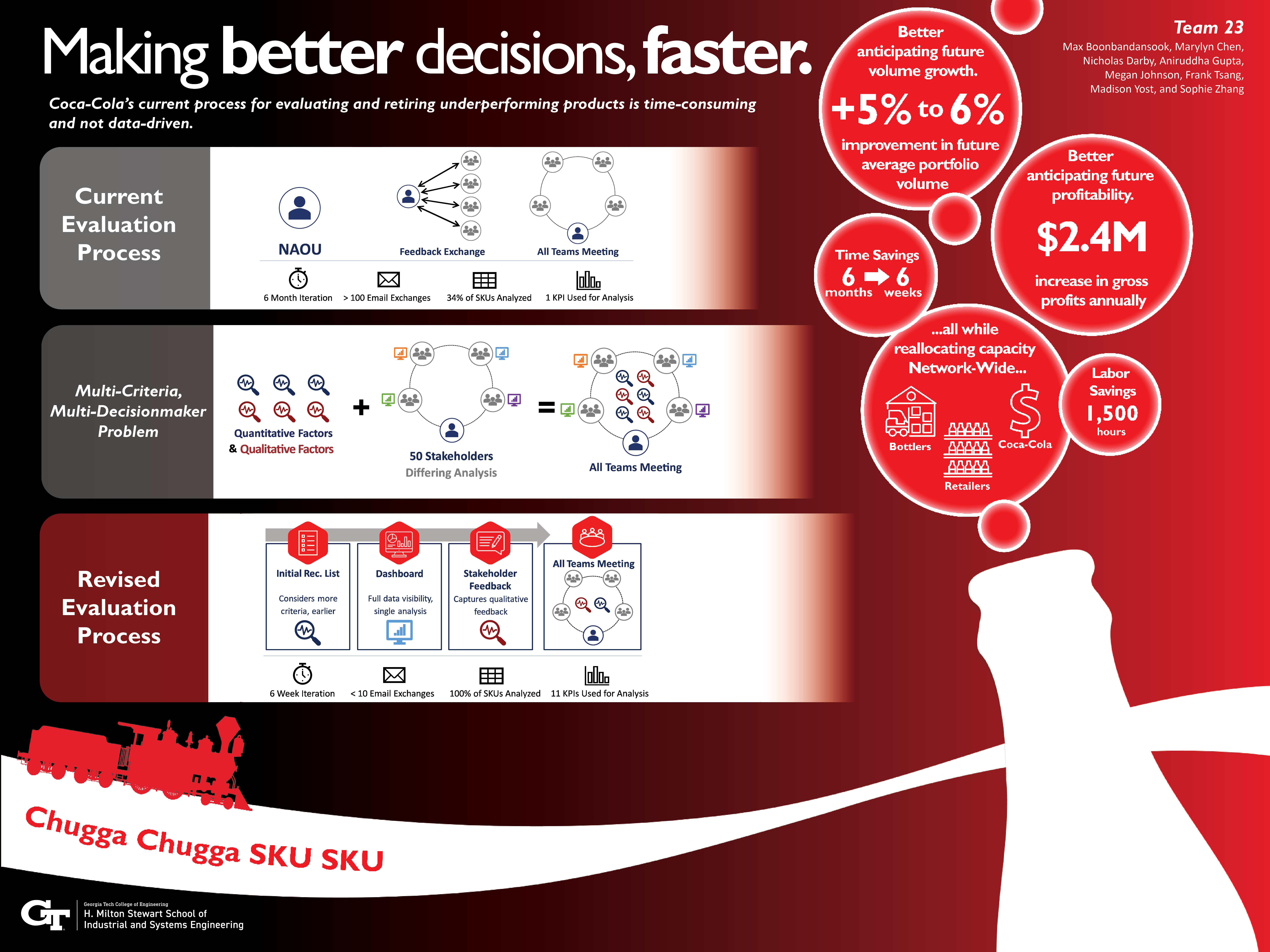

PDF) Valuing Coca-Cola and Pepsi Options Using the Black-Scholes Option Pricing Model and Downloads from the Internet